In today’s digital age, the dark underbelly of the internet hosts a myriad of illicit activities, one of the most prominent being the trade of stolen credit card information. Among the platforms notorious for facilitating such activities is Bclub, a marketplace specializing in dumps and CVV2 data. We’ll explore the workings of Bclub, the significance of dumps and CVV2 shops, and the broader implications for credit card security.

Understanding Dumps and CVV2 Shops

To fully comprehend the operations of Bclub, it is crucial to understand the terms “dumps” and “CVV2 shops.” Dumps refer to the data extracted from the magnetic stripe of a credit card. This information includes the card number, expiration date, and sometimes the cardholder’s name. Cybercriminals use this data to create counterfeit cards, which can then be used for unauthorized transactions in physical stores.

CVV2 shops, on the other hand, specialize in selling the three-digit security codes found on the back of credit cards. These codes are crucial for verifying card-not-present transactions, such as online purchases. When combined with other card details, CVV2 codes enable criminals to make fraudulent transactions over the internet.

The Role of Bclub in the Underground Market

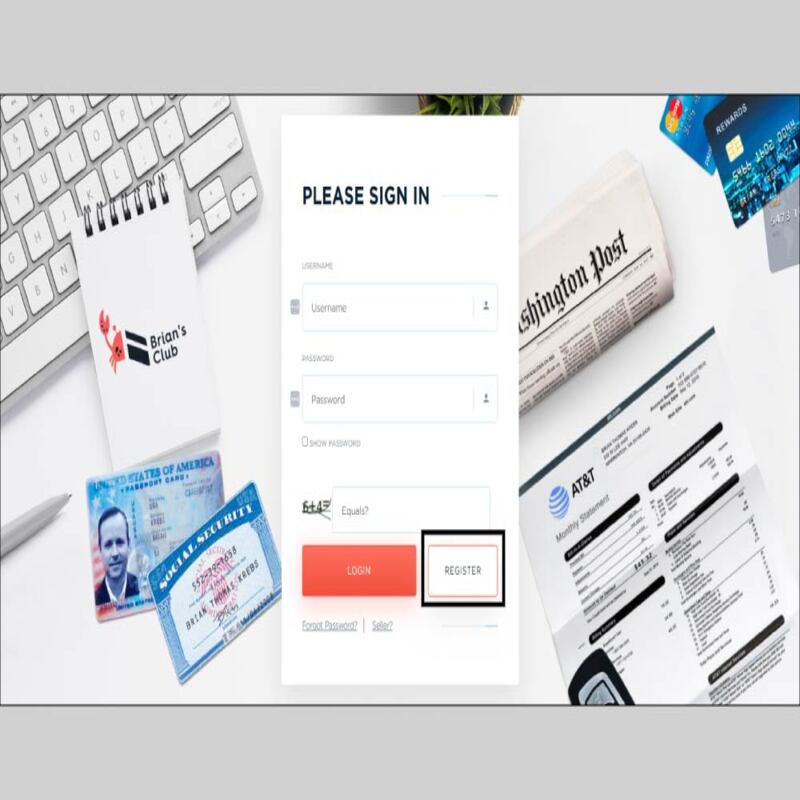

Bclub has established itself as a significant player in the underground market for stolen credit card information. It operates similarly to a legitimate e-commerce platform, providing a marketplace where cybercriminals can buy and sell stolen credit card data. Here’s a closer look at what makes Bclub a focal point in this illicit trade:

User-Friendly Interface

One reason for Bclub’s popularity is its user-friendly interface. Designed to be easily navigable, the platform caters even to those with limited technical skills. This accessibility lowers the barrier to entry for aspiring cybercriminals, contributing to the proliferation of stolen credit card data.

Pricing and Data Quality

The pricing of dumps and CVV2 data on Bclub varies based on several factors, such as the card issuer, the cardholder’s country, and the card’s credit limit. Generally, cards with higher credit limits and those from wealthy countries are more expensive. Additionally, the freshness and verification status of the data impact its price—recently stolen and verified data is priced higher due to its increased likelihood of successful exploitation.

Anonymity and Security

Bclub places a strong emphasis on anonymity and security. Transactions are typically conducted using cryptocurrencies like Bitcoin, which offer a degree of anonymity. The platform also employs various security measures, such as encryption and secure communication channels, to protect the identities of its users.

The Impact on Credit Card Security

The activities facilitated by Bclub have significant implications for credit card security. The widespread availability of stolen credit card data results in a surge in fraudulent transactions, causing substantial financial losses and eroding consumer trust in the financial system.

Financial Losses

The financial impact of credit card fraud is enormous. Financial institutions often absorb these losses by reimbursing victims for unauthorized transactions. These costs are ultimately passed on to consumers through higher fees and interest rates. Furthermore, the expenses associated with investigating and mitigating fraud further strain financial resources.

Erosion of Consumer Trust

The existence of platforms like Bclub undermines consumer trust in the financial system. Victims of credit card fraud may become hesitant to use their cards for online transactions, fearing further fraud. This hesitancy can negatively impact the growth of e-commerce and other digital financial services, as consumers may revert to more secure but less convenient payment methods.

Regulatory Responses

In response to the growing threat of credit card fraud, regulators worldwide have implemented stricter security standards. Measures such as EMV chip technology, two-factor authentication, and real-time transaction monitoring aim to curb fraudulent activities. However, as cybercriminals become more sophisticated, regulatory frameworks must continuously evolve to address emerging threats.

Strategies to Mitigate Risks

While platforms like Bclub pose significant challenges, there are several strategies that individuals and financial institutions can adopt to mitigate the risks associated with credit card fraud.

For Individuals

-

Monitor Account Activity: Regularly reviewing bank statements and credit card transactions can help individuals quickly identify and report unauthorized activity.

-

Use Secure Payment Methods: Utilizing secure payment methods, such as virtual credit cards or payment services with robust fraud protection, can minimize exposure to fraud.

-

Exercise Caution Online: Avoiding suspicious websites and phishing scams is crucial. Always ensure that online transactions are conducted on secure, encrypted websites.

For Financial Institutions

-

Enhance Security Measures: Implementing advanced security measures, such as machine learning algorithms for fraud detection, can help identify and prevent fraudulent transactions in real-time.

-

Educate Consumers: Financial institutions should invest in educating their customers about the risks of credit card fraud and the steps they can take to protect themselves.

-

Collaborate with Law Enforcement: Working closely with law enforcement agencies can help track and dismantle platforms like Bclub, disrupting the supply chain of stolen credit card data.

The Future of Credit Card Security

As the battle between cybersecurity experts and cybercriminals continues, staying informed and proactive is essential. The landscape of credit card fraud is constantly evolving, with new tactics and technologies emerging regularly. Both individuals and financial institutions must remain vigilant and adaptive to protect against these threats.

Technological Advancements

Emerging technologies such as artificial intelligence (AI) and blockchain hold promise for enhancing credit card security. AI can improve fraud detection by analyzing transaction patterns and identifying anomalies more accurately than traditional methods. Blockchain technology, with its decentralized and immutable nature, can provide secure and transparent transaction records, reducing the risk of fraud.

Ongoing Education and Awareness

Continual education and awareness efforts are crucial in the fight against credit card fraud. Financial institutions must keep their customers informed about the latest threats and best practices for safeguarding their information. Similarly, individuals should stay educated about the evolving tactics used by cybercriminals and take proactive steps to protect their financial data.

Conclusion

The underground market for dumps and CVV2 data is a complex and ever-evolving ecosystem. Platforms like Bclub play a significant role in facilitating the trade of stolen credit card information, posing substantial risks to both individuals and financial institutions. By understanding the operations of these platforms and implementing robust security measures, we can mitigate the impact of credit card fraud and protect the integrity of our financial systems. As technology advances and cybercriminals become more sophisticated, the need for vigilance and proactive measures remains paramount. Staying informed and adopting best practices for credit card security will be essential in safeguarding against the persistent threat of fraud.