views

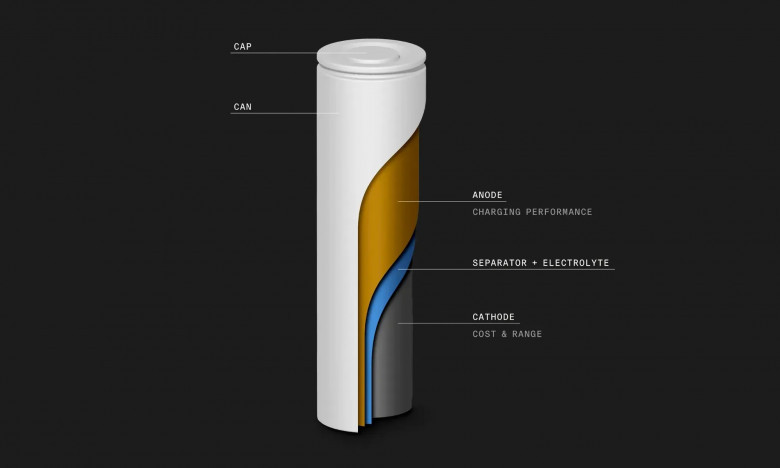

The lithium-ion battery cathode market has become a cornerstone of the global push toward electrification and sustainable energy solutions. As cathodes are essential components that determine a battery's energy density, lifespan, and safety, they represent a significant segment of the overall battery market. The growing demand for electric vehicles (EVs), renewable energy storage systems, and portable electronics is fueling rapid growth in this market. This article provides a comprehensive summary of the lithium-ion battery cathode market, highlighting key trends, applications, regional insights, and future prospects.

Cathode Materials Overview

Lithium-ion battery cathodes are made from various chemical compositions, each with unique properties and use cases. The most widely used cathode materials include:

-

Nickel Manganese Cobalt Oxide (NMC): Balances energy density and stability, popular in EVs.

-

Nickel Cobalt Aluminum Oxide (NCA): Offers high energy density, mainly used in high-performance vehicles.

-

Lithium Iron Phosphate (LFP): Known for safety, long life, and thermal stability; increasingly favored in low-to-mid-range EVs and stationary storage.

-

Lithium Manganese Oxide (LMO): Delivers good thermal stability and moderate energy density.

Market participants are increasingly exploring high-nickel and cobalt-free formulations to address cost and sustainability issues while maximizing performance.

Market Drivers

Several factors are driving growth in the lithium-ion battery cathode market:

-

Electric Vehicle Expansion: The accelerating adoption of EVs globally is a primary growth engine. Automakers are investing heavily in EV platforms, creating vast demand for high-capacity, safe, and affordable batteries.

-

Renewable Energy Storage: As solar and wind power generation grows, the need for grid-scale energy storage systems that use lithium-ion batteries has surged.

-

Government Policies and Incentives: Global regulatory initiatives, such as emissions reduction targets, EV subsidies, and bans on internal combustion engines, are indirectly boosting cathode material demand.

-

Consumer Electronics Growth: Smartphones, laptops, and wearables continue to require compact, long-lasting batteries, supporting steady cathode demand.

Challenges Facing the Market

Despite its growth, the cathode market faces several challenges:

-

Raw Material Constraints: The supply of critical materials like cobalt, lithium, and nickel is limited and often geographically concentrated, leading to supply chain risks and price volatility.

-

Environmental and Ethical Concerns: Mining activities for these materials raise environmental and ethical issues, prompting a shift toward recycling and responsible sourcing.

-

High Production Costs: Manufacturing cathode materials involves energy-intensive processes and requires advanced quality control, making it a capital-heavy operation.

-

Technology Uncertainty: Rapid innovation means manufacturers must continuously adapt to new chemistries, such as solid-state batteries, which may eventually replace current lithium-ion technology.

Regional Analysis

-

Asia-Pacific: Dominates the market due to a robust manufacturing ecosystem in China, South Korea, and Japan. These countries host major battery and cathode material producers.

-

North America: The U.S. is investing in local battery manufacturing through public-private partnerships to reduce reliance on imports and build a domestic supply chain.

-

Europe: Strong environmental policies and automotive electrification targets have led to large-scale investments in cathode material production and battery gigafactories.

-

Rest of the World: Countries in Latin America and Africa are important for raw material mining, while Southeast Asia is emerging as a key manufacturing base.

Emerging Trends

-

Rise of LFP: LFP chemistry is gaining popularity due to its lower cost, improved safety, and long cycle life. It’s especially attractive for low-cost EVs and stationary storage.

-

Cobalt Reduction: Manufacturers are developing high-nickel or cobalt-free cathode materials to reduce reliance on ethically and environmentally controversial cobalt mining.

-

Recycling and Second-Life Batteries: The market is seeing growing interest in battery recycling technologies and second-life applications, which support sustainability and circular economy goals.

-

Vertical Integration: Companies are increasingly integrating upstream and downstream processes to secure raw materials and ensure supply chain stability.

Competitive Landscape

The market is moderately consolidated, with major players including Umicore, BASF, Sumitomo Metal Mining, POSCO Future M, LG Chem, and CATL. These companies are investing heavily in R&D, capacity expansion, and partnerships to maintain competitiveness. Meanwhile, new entrants are bringing innovation, especially in eco-friendly and cost-efficient cathode technologies.

Future Outlook

The lithium-ion battery cathode market is expected to witness strong growth over the next decade, driven by rising EV penetration, energy storage needs, and advancements in battery technology. The focus will likely shift toward sustainable practices, localized production, and next-generation chemistries.

Innovation in solid-state batteries, enhanced recycling infrastructure, and geopolitical efforts to secure supply chains will define the future competitive dynamics. As battery performance becomes a critical differentiator in clean energy and mobility, cathode materials will remain at the heart of technological and commercial progress.

Conclusion

The lithium-ion battery cathode market is at the forefront of the global energy transition. With its central role in determining battery performance and safety, the cathode segment is poised for continued expansion. Despite facing challenges such as raw material constraints and high production costs, ongoing innovations, strategic investments, and policy support are creating a robust growth landscape. Stakeholders who navigate these dynamics effectively will be well-positioned in the evolving energy and mobility ecosystem.

Comments

0 comment