In the realm of healthcare, effective Revenue Cycle Management is absolutely paramount for the financial health of medical practices. It ensures that healthcare providers receive payments for their services in a timely and efficient manner. In this comprehensive guide, we'll explore the critical steps to keep your practice's RCM system robust and healthy.

At its core, revenue cycle management is the systematic tracking of the financial aspects of a patient's journey, from the moment they schedule an appointment to the point where the practice successfully receives payment. A well-managed revenue cycle is indispensable in maintaining a healthy cash flow and ensuring the financial stability of healthcare organizations.

Understanding Revenue Cycle Management

Let's delve deeper into the vital components that constitute a healthy RCM system:

1. Patient Pre-Registration

Patient pre-registration is the crucial first step in the revenue cycle. It involves collecting comprehensive and accurate patient information, including personal and insurance details. This step ensures that the practice has all the necessary data to bill the patient's visit properly. It also sets the stage for a personalized and efficient patient experience, where the staff can verify insurance eligibility and address potential financial concerns ahead of the appointment.

2. Appointment Scheduling

Efficient appointment scheduling practices are instrumental in reducing the occurrence of no-shows and cancellations. Patients are more likely to attend their appointments when the scheduling process is convenient and clear. Implementing reminders and confirmations, whether through phone calls, emails, or text messages, can significantly boost appointment adherence, ensuring a consistent patient flow and reducing lost revenue. Patient scheduling is considered the front line to encourage the patient to either come to your practice or any other. Ultimately all this helps to achieve or amend the revenue cycle management that has a long go.

3. Insurance Verification: Critical Steps in Revenue Cycle Management

Thoroughly verifying patient insurance eligibility is essential to preventing costly claim denials. Insurance policies can change, and patients may not always be aware of updates to their coverage. Ensuring that insurance coverage is in place before the appointment allows you to determine the patient's financial responsibility accurately. This step not only prevents financial surprises for patients but also helps your practice avoid billing errors and delays.

4. Point-of-Service Collections

Encouraging upfront payment or co-pays at the time of service is a proactive measure that can significantly enhance your practice's revenue stream. Patients are more likely to fulfill their financial obligations when asked at the point of service. Implementing a clear and friendly payment process at the front desk can not only improve cash flow but also reduce the risk of unpaid balances and delayed payments.

5. Precise Coding

Accurate coding is the cornerstone of successful claims submission. Accurate medical coding ensures that healthcare services are properly documented and billed, reducing the likelihood of claim denials and delays in reimbursement. Proper coding is essential in communicating the details of patient care to payers and ensuring that the practice receives the correct payment for services provided. Correct coding is the cornerstone of maintaining efficient revenue cycle management in any practice.

6. Claims Submission

Timely submission of clean claims is essential to reducing the risk of rejection and speeding up the payment process. Claims should be submitted promptly after the patient's visit, and they should be "clean," meaning that they are free from errors or missing information. Delays in claim submission can result in delayed revenue, impacting the practice's financial health and increasing the risk of denied claims.

7. Payment Posting

Accurate recording of payments received from both insurers and patients is paramount in maintaining financial transparency and reducing discrepancies. Accurate payment posting ensures that payments are correctly allocated to patient accounts and reflects the practice's true financial status. This step not only helps in tracking revenue but also in reconciling accounts and addressing any discrepancies promptly.

8. Denial Management

Efficiently addressing claim denials in a timely manner is the key to maximizing reimbursements and preventing revenue leakage. Claim denials can occur for various reasons, including coding errors, incomplete documentation, or insurance disputes. Addressing denials promptly and identifying their root causes is crucial for revenue recovery. Effective denial management involves a systematic process for identifying, appealing, and resolving denied claims.

9. Accounts Receivable Follow-Up

Regularly following up on unpaid claims and outstanding patient balances is essential in ensuring that the practice receives the revenue it's owed. Accounts receivable follow-up involves consistent communication with insurers and patients to resolve outstanding balances. It often includes sending statements, making phone calls, and addressing any questions or disputes related to payments. Timely follow-up can reduce the risk of bad debt and improve cash flow.

10. Financial Reporting

Regular analysis of financial reports can unearth areas that require improvement. The practice should regularly review key performance indicators (KPIs) such as accounts receivable aging reports, denial rates, and collections efficiency. This data helps identify areas for improvement and guides strategic decisions. Financial reporting provides insights into the financial health of the practice and allows for data-driven decision-making to optimize revenue cycle management.

Impacts of Revenue Cycle Management Companies on the bottom line

Revenue cycle management companies play a crucial role in improving the bottom line of healthcare organizations. Firstly, they streamline and optimize the billing and reimbursement process, reducing claim denials and accelerating the revenue collection cycle. By ensuring accurate and timely submission of claims, RCM companies help healthcare providers maximize their revenue potential.

Secondly, Revenue Cycle Management companies also aid in cost reduction through efficient financial management. They implement advanced technologies and best practices to reduce operational costs, such as administrative expenses and labor costs. Additionally, by providing insights into financial performance and revenue trends, RCM companies empower healthcare organizations to make informed decisions and strategically plan for the future, ultimately contributing to a healthier bottom line.

Revenue Cycle Management

Tips for a Healthy Revenue Cycle Management

Now, let's delve into strategies that will help maintain a robust RCM system:

1. Up-to-Date Technology

Investing in cutting-edge RCM software and tools that streamline the process is a strategic move. Modern software is designed to automate tasks, reduce errors, and increase efficiency. By automating repetitive tasks, staff can focus on more complex and strategic aspects of Revenue Cycle Management, such as analyzing data, identifying trends, and implementing improvements.

2. Accurate Coding and Documentation

Ensuring the proper coding and documentation of patient encounters is the bedrock of accurate billing and timely reimbursements. Accurate coding and comprehensive documentation provide a solid foundation for clean claims. It's essential to stay current with coding updates and guidelines to minimize the risk of claim denials.

3. Insurance Verification

It's critical to verify patient insurance eligibility before appointments. This not only reduces claim denials but also helps in determining the patient's financial responsibility, promoting financial transparency. Verifying insurance eligibility upfront avoids unexpected billing issues for patients and prevents misunderstandings.

4. Regular Audits

Conducting periodic audits is essential for identifying any inconsistencies or issues in your revenue cycle. Swiftly addressing these issues helps maintain a streamlined and efficient system. Regular audits involve a thorough review of RCM processes, claims, and financial data. Audits help uncover areas that require improvement and ensure compliance with regulations and best practices.

5. Denial Management

Creating a dedicated process for addressing claim denials is essential in identifying the root causes and implementing corrective measures. Denial management involves not only addressing individual denials but also implementing systemic changes to reduce denials in the future. It often requires a multi-step approach, including identifying denial reasons, appealing denied claims, and tracking denial trends.

6. Outsourcing RCM

Consider outsourcing your RCM to experts who specialize in revenue cycle management. This strategic move can free up internal resources and dramatically improve efficiency. RCM outsourcing providers bring expertise and advanced technology to the table, reducing the burden on your in-house staff. They often have specialized knowledge of billing, coding, and claim submission, which can lead to higher revenue collection and faster reimbursement.

What Stand-Out NEO MD Medical Billing Services?

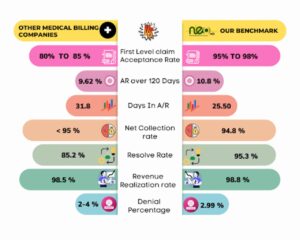

NEO MD stood best among competitors’ Revenue Cycle Management Companies due to the following cores;

- Our experts work hard to reduce your front-end denials by 20%.

- Claim first level acceptance ratio; 95-97%

- Offer Provider & Staff Productivity Analysis

- Refunds adjustment and Payment posting to improve the cash flow.

- Offer Services that are easily scalable at all times.

- We have consistently increased the collection rate for our clients because of the faster increase in the accuracy of fees and collection.

- Offering state-of-the-art medical billing services for small practices, medium-sized, and large ones.

- Improve RCM system efficiency with a robust credentialing team.

- Provide fortnightly financial and practice overviews

- Offer internal Medical Billing audits to uncover loopholes

- Use the latest technology and tools.

- Deliver customized Revenue Cycle Management Services to unearth operation shortcomings.

- Successfully opens insurance panel for providers

- Out of Network Negotiations.

- Provide unrivaled Billing and collection services that are of high quality and error-free.

Conclusion

In summary, a healthy revenue cycle management system is non-negotiable for the financial stability of medical practices. By implementing the strategies mentioned above and staying abreast of industry changes, you can maintain a robust revenue cycle that maximizes revenue while minimizing errors and inefficiencies.

By diligently following these best practices, you can ensure that your practice's revenue cycle remains healthy and sustainable in the long run, allowing you to focus on providing quality healthcare to your patients while securing your financial future.