Small-cap funds are known for their potential to deliver high returns by investing in companies that are still in their early stages of growth. Both the Axis Small Cap Fund Direct Growth and Canara Robeco Small Cap Fund aim to provide capital appreciation through investments in small-cap stocks. However, they differ in terms of strategy, risk exposure, and overall portfolio management. This comparison will help investors understand the unique features of both funds and choose based on their financial goals and risk appetite.

Investment Focus and Strategy

- Axis Small Cap Fund Direct Growth: This fund focuses on building a portfolio of high-growth small-cap companies with robust potential. The fund management team follows a research-driven approach, selecting companies that have strong fundamentals and the potential to become future industry leaders. Its strategy tends to be more conservative within the small-cap space, focusing on quality businesses that show financial resilience.

- Canara Robeco Small Cap Fund: The Canara Robeco Small Cap Fund has a slightly more aggressive approach. It looks for opportunities in small-cap companies that are currently undervalued but have the potential for significant future growth. The fund aims to capture returns from stocks that are poised to outperform in the long term.

Risk and Volatility

- Axis Small Cap Fund Direct Growth: Given its conservative approach within the small-cap universe, the Axis Small Cap Fund tends to exhibit lower volatility compared to other small-cap funds. The focus on financially stable companies reduces the overall risk, although small-cap investments, by nature, carry high risk.

- Canara Robeco Small Cap Fund: This fund carries a higher risk profile as it looks to maximize returns by investing in potentially volatile small-cap stocks. However, the fund’s aggressive approach also provides opportunities for higher returns if these companies experience substantial growth.

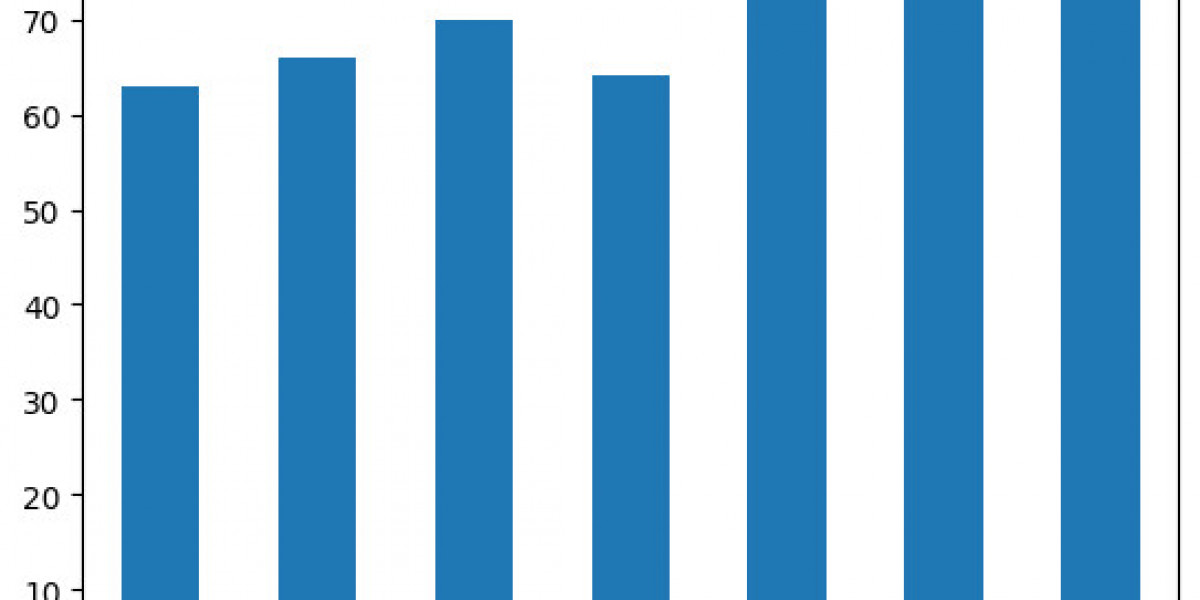

Portfolio Management and Performance

- Axis Small Cap Fund Direct Growth: Managed by a team of seasoned professionals, the fund has consistently delivered stable returns relative to its peer group. It emphasizes risk management while selecting companies, which has contributed to its steady performance even during periods of market turbulence.

- Canara Robeco Small Cap Fund: This fund has a strong track record of identifying under-the-radar companies with high growth potential. The fund management team’s focus on tapping into emerging small-cap companies has helped it generate impressive returns, especially during bullish market phases.

Which One to Choose?

- Axis Small Cap Fund Direct Growth: Ideal for investors who prefer a more balanced approach to small-cap investing. If you are looking for long-term capital appreciation but with a slightly lower risk profile within the small-cap category, this fund could be a better fit.

- Canara Robeco Small Cap Fund: Suited for more aggressive investors with a high risk tolerance who are willing to weather market volatility in pursuit of higher long-term gains. If you have a long investment horizon and are prepared for potential short-term fluctuations, this fund offers strong growth potential.

Both the Axis Small Cap Fund Direct Growth and Canara Robeco Small Cap Fund offer compelling opportunities for investors looking to gain exposure to the small-cap segment. Your choice between the two depends largely on your risk appetite and investment goals. While Axis offers a more conservative path with quality-focused small-cap investments, Canara Robeco presents a more aggressive approach that could lead to higher rewards over the long term.