IMARC Group has recently released a new research study titled “Core Banking Software Market Report by Solution (Deposits, Loans, Enterprise Customer Solutions, and Others), Service (Professional Service, Managed Service), Deployment (Cloud-based, On-premise), End Use (Banks, Financial Institutions, and Others), and Region 2025-2033”, offers a detailed analysis of the global market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

How big is the core banking software market?

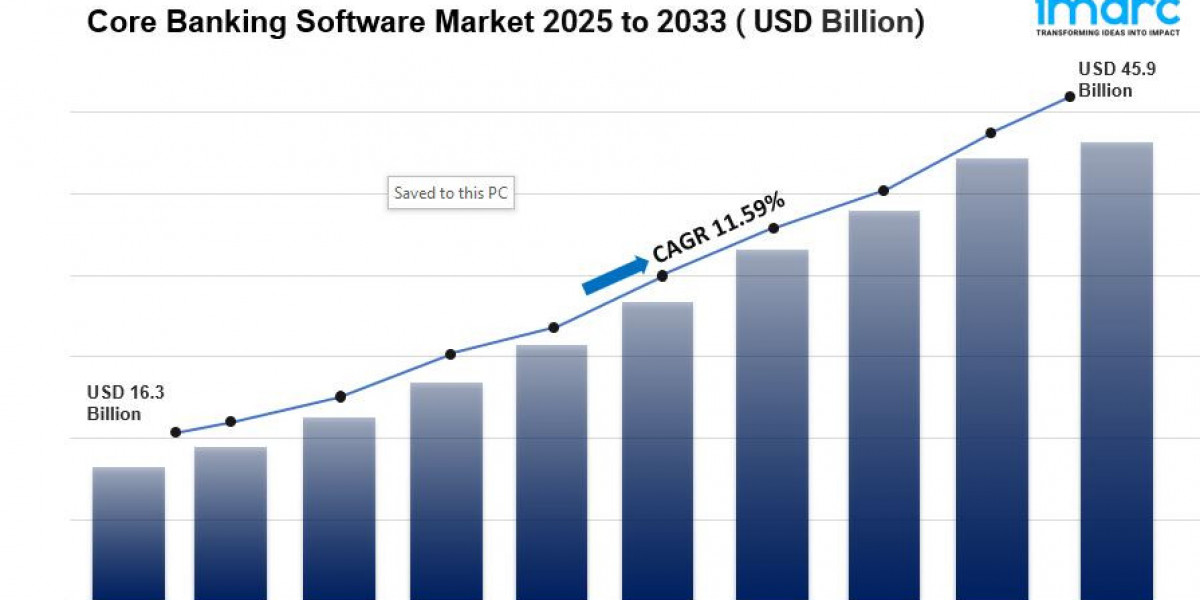

The global core banking software market size reached USD 16.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 45.9 Billion by 2033, exhibiting a growth rate (CAGR) of 11.59% during 2025-2033. The increasing digital transformation, the implementation of government regulations, growing need for cost-efficiency, rising fintech services, widespread consumers preference for digital solutions, and the increasing focus on small and medium-sized enterprises (SMEs) are some of the major factors propelling the market.

Global Core Banking Software Market Trends:

The shift to cloud solutions is boosting the core banking software market. It offers banks scalability, cost savings, and quick service updates. This is vital for staying competitive in a digital world. Additionally, the market is seeing more use of AI and machine learning. These technologies enhance customer experiences, improve risk management, and automate tasks. Cybersecurity is becoming more important in core banking, due to rising cyber threats. Meanwhile, open banking is on the rise. Banks are using open APIs to share data securely with third parties. This fosters innovation and allows for more personalized services.

Factors Affecting the Growth of the Core Banking Software Industry:

Digital Transformation in the Banking Sector:

The core banking software market is driven by digital transformation in banking. Now, digital banking is standard. Banks must update old systems to meet customer demands for speed, convenience, and access. This move is also to stay competitive against fintech startups and online-only banks. Core banking software is key. It offers flexible solutions that help banks operate better, launch products faster, and enhance digital services. The COVID-19 pandemic sped up this shift to digital banking. It pushed both customers and banks towards online and mobile services, raising the need for advanced core banking systems.

Integration of Advanced Technologies:

Cutting-edge tech transforms core banking software from mere transaction handler to strategic asset. AI and machine learning personalize customer interactions, sharpening decision-making and risk management. Blockchain fortifies security, thwarting fraud attempts. Cloud migration slashes expenses and simplifies operations. This digital shift empowers banks with unparalleled agility, adapting swiftly to market dynamics and evolving customer demands. The result? A revolutionized banking landscape where technology drives innovation and competitive edge.

Regulatory Compliance and Cybersecurity:

In the banking industry, compliance with regulations is vital. Core banking software aids banks in meeting these local and global standards. It also protects sensitive data from advanced cybersecurity threats. The demand for such software is rising, driven by the need for strong security against data breaches and cyber-attacks.

Request to Get the Sample Report: https://www.imarcgroup.com/core-banking-software-market/requestsample

Core Banking Software Market Report Segmentation:

By Solution:

- Deposits

- Loans

- Enterprise Customer Solutions

- Others

Enterprise Customer Solutions lead the core banking software market as they enable banks to provide personalized and efficient services to customers, enhancing customer engagement and loyalty.

By Service:

- Professional Service

- Managed Service

Professional services dominate the service segment due to the need for expert assistance in implementing, updating, and maintaining complex core banking systems.

By Deployment:

- Cloud-based

- On-premise

On-premise deployment remains the largest in the market because of its perceived reliability and security, especially among traditional banks dealing with sensitive financial data.

By End User:

- Banks

- Financial Institutions

- Others

Banks constitute the largest end-user segment for core banking software, as these solutions are fundamental to their operations, streamlining processes like account management, transaction processing, and compliance.

By Region:

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East and Africa

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=3649&flag=C

Competitive Landscape:

The competitive landscape of the core banking software market has been studied in the report with the detailed profiles of the key players operating in the market.

- Capgemini

- Fidelity Information Services Inc.

- Finastra

- Fiserv Inc.

- HCL Technologies Limited

- Infosys Limited

- Jack Henry & Associates Inc.

- Oracle Corporation

- SAP SE

- Tata Consultancy Services Limited

- Temenos AG

- Unisys Corporation

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145