The real estate market is poised for steady growth, with a projected compound annual growth rate (CAGR) of 5.0% from 2025 to 2033. This expansion is primarily driven by factors such as population growth, increasing urbanisation, and rising demand for high-quality housing and infrastructure. In this article, we explore the key elements shaping the global real estate market, including its overview, size and share, market dynamics, growth prospects, opportunities and challenges, as well as competitive landscape.

Overview of the Global Real Estate Market

The global real estate market encompasses the buying, selling, and renting of properties, which include residential, commercial, industrial, and land properties. The sector has a significant impact on economic development, employment, and wealth generation across the globe. With rapid urbanisation and changing consumer preferences, the real estate industry has seen significant shifts in demand patterns, especially for quality housing, commercial spaces, and infrastructure development.

As economies grow, there is a noticeable increase in the demand for residential homes, business spaces, and more advanced infrastructure, which boosts the global real estate market. The rising middle class, economic development in emerging markets, and the continued digital transformation in the property sector are also influencing growth.

Get a Free Sample Report with a Table of Contents:

https://www.expertmarketresearch.com/reports/real-estate-market/requestsample

Size & Share of the Global Real Estate Market

In recent years, the global real estate market has seen substantial growth, and it is expected to maintain a steady upward trajectory. The market's size is driven by various factors such as population growth, migration to urban areas, and increasing disposable income, which lead to heightened demand for real estate properties across various segments.

Market Segmentation:

By Property Type:

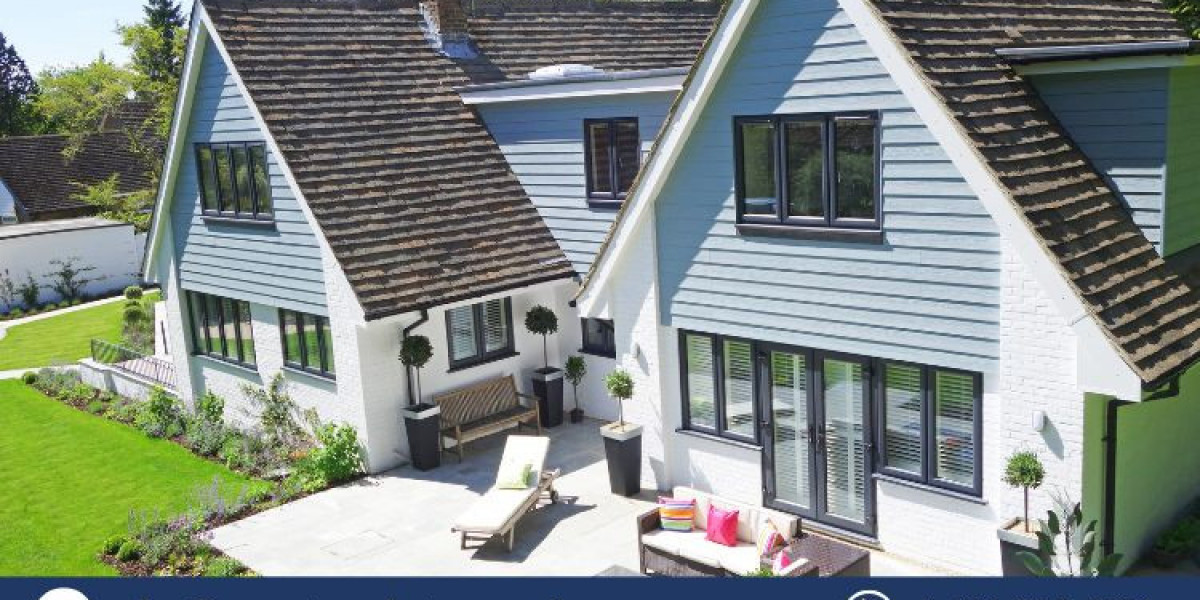

Residential Real Estate: This segment remains the largest due to the growing need for housing, particularly in urban areas and developing economies. Residential real estate includes single-family homes, multi-family homes, and apartments.

Commercial Real Estate: This includes office buildings, retail spaces, and commercial establishments. Demand is driven by business expansion, increasing consumer spending, and a growing number of multinational corporations.

Industrial Real Estate: This segment covers warehouses, distribution centres, and manufacturing facilities, driven by growth in e-commerce, logistics, and industrial development.

Land: Land investments continue to rise due to expansion in urban areas and infrastructure development.

By Geography:

North America: The real estate market in the United States and Canada remains strong, with continued demand for residential properties and commercial spaces.

Europe: Countries like Germany, the UK, and France continue to attract real estate investments, particularly in commercial and residential sectors.

Asia-Pacific: With rapid urbanisation and industrialisation, countries like China, India, and Japan are witnessing significant real estate growth, particularly in the residential and commercial sectors.

Middle East & Africa: The demand for real estate is growing, particularly in emerging economies, driven by construction projects, urbanisation, and the expansion of infrastructure.

Market Dynamics & Trends

Key Drivers:

Population Growth & Urbanisation: Rapid population growth, particularly in developing economies, has led to increased demand for housing and infrastructure. Urbanisation is accelerating the need for residential and commercial spaces in cities.

Rising Income & Affordability: As disposable income rises in emerging markets, the demand for quality housing and commercial spaces increases. Affordability plays a crucial role in determining real estate demand in these regions.

Government Policies & Infrastructure Development: Government initiatives, such as affordable housing schemes and infrastructure development projects, are driving growth in the real estate market. Public-private partnerships are also playing a vital role in shaping the market.

Technological Advancements: The increasing use of digital platforms for property search, virtual tours, and online transactions is reshaping the real estate industry. The adoption of artificial intelligence (AI) and big data analytics is enhancing decision-making in property investments.

Emerging Trends:

Green and Sustainable Buildings: There is an increasing trend towards eco-friendly and sustainable buildings, with a focus on energy-efficient designs, use of renewable materials, and low carbon footprints. Consumers and investors are becoming more environmentally conscious, which is driving this trend.

Smart Homes: The growing demand for smart homes equipped with IoT (Internet of Things) devices such as thermostats, security systems, and voice-controlled systems is gaining momentum in residential real estate.

Real Estate Investment Trusts (REITs): Investors are increasingly turning to REITs as a way to gain exposure to real estate markets without the need to own physical properties. This trend is helping to attract more institutional investments into the sector.

Hybrid Work Models & Commercial Real Estate: The post-pandemic world has witnessed the rise of hybrid work models, influencing the demand for office spaces. Businesses are rethinking their office space requirements, which is reshaping the commercial real estate landscape.

Growth of the Global Real Estate Market

The global real estate market is expected to grow significantly, driven by various growth factors:

Increased Urbanisation: The ongoing migration to urban centres in emerging economies, coupled with rapid industrialisation, is creating an unprecedented demand for residential, commercial, and industrial real estate.

Technological Transformation: Digital transformation and the growing adoption of property technology (PropTech) is streamlining transactions, property management, and investment processes, enhancing market efficiency and driving growth.

Economic Recovery: As economies recover from global disruptions like the pandemic, the demand for real estate, both residential and commercial, is expected to see a strong rebound, particularly in developed and emerging markets.

Market Opportunities and Challenges

Opportunities:

Affordable Housing Initiatives: Government-driven affordable housing projects are gaining traction, especially in developing nations, offering substantial growth opportunities for real estate developers and investors.

Luxury Real Estate: The demand for luxury real estate is growing in affluent regions and emerging markets. The increasing wealth of high-net-worth individuals (HNWIs) is driving investments in premium residential and commercial properties.

Green Real Estate: As sustainability becomes a priority for both investors and consumers, there is a growing opportunity in the development of energy-efficient and eco-friendly properties.

Growing Commercial Real Estate: The rise of e-commerce and logistics is driving the demand for warehouses, distribution centres, and logistics hubs, presenting significant opportunities in industrial real estate.

Challenges:

Regulatory and Legal Barriers: Stringent regulations, zoning laws, and approval processes in various regions can pose challenges for developers and investors in the real estate market.

Economic Uncertainty: Economic downturns, political instability, and geopolitical risks can negatively impact real estate investments, particularly in regions that are already vulnerable.

Rising Material Costs: The increasing cost of construction materials, labour shortages, and supply chain disruptions can hinder real estate development projects, especially in the residential sector.

Competitor Analysis

The global real estate market is highly competitive, with several key players dominating the industry. These companies are leveraging various strategies, including mergers, acquisitions, strategic partnerships, and technology integration to strengthen their market positions.

Key Players:

CBRE Group, Inc. (USA): One of the largest real estate services firms globally, CBRE offers a wide range of services, including property management, investment, and leasing.

Jones Lang Lasalle Incorporated (JLL) (USA): A leading global real estate services company, JLL operates in over 80 countries and provides services such as real estate investment management, property management, and consulting.

Brookfield Asset Management (Canada): Brookfield is a global asset management company with substantial holdings in real estate, including residential, commercial, and industrial properties.

Daiwa House Industry Co., Ltd. (Japan): A major player in real estate development, Daiwa House focuses on residential, commercial, and industrial properties, particularly in the Asia-Pacific region.

Zillow Group, Inc. (USA): A leading online real estate marketplace, Zillow offers property listings, home value estimates, and digital transaction platforms.

These companies are focusing on expanding their geographical presence, adopting innovative technologies, and offering integrated real estate solutions to meet the evolving needs of consumers and investors.

View Our related Blogs and Post:

HVAC Companies

https://alumni.myra.ac.in/read-blog/147652