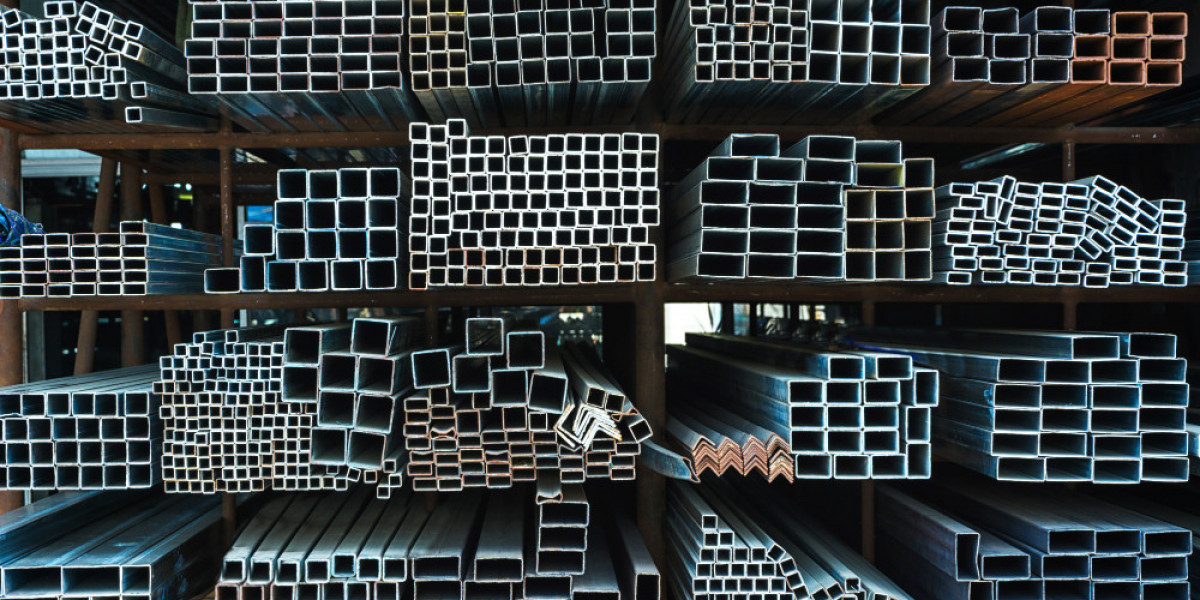

Metal prices are known to go up and down frequently due to market changes, supply issues, and global events. For some, this price volatility can seem risky, but for smart investors, it’s an opportunity to make profits. By understanding the reasons behind these price changes and using tools like PriceVision, you can take advantage of metal live price movements and make informed decisions. This guide will explain how you can navigate the ups and downs of the metal market and turn volatility into a profit-making opportunity.

Why Do Metal Prices Fluctuate?

Metal prices don’t stay the same—they change all the time because of various reasons. Understanding what causes these changes is the first step toward making smart investments.

1. What Causes Metal Price Volatility?

The metal live price of metals like gold, silver, copper, and aluminum can change because of supply and demand, economic conditions, and market speculation. For example, if there’s a shortage of metal supply, prices can rise quickly. Similarly, global events like trade wars, inflation, or political instability can cause sudden price jumps or drops.

2. Is Price Volatility an Opportunity?

Yes, it can be. When prices go up and down, you can buy metals at a low price and sell them when prices are high. But to do this effectively, you need to stay updated on the market and use the right strategies to manage the risks that come with volatility.

Strategies to Profit from Metal Price Changes

To make the most of the changing metal live price, you need to follow certain strategies that can help you reduce risks and increase profits. Let’s look at some effective methods.

1. Track Metal Live Prices Regularly

Keeping an eye on metal prices is very important. By staying updated, you can take advantage of price changes as they happen. Platforms like PriceVision provide real-time updates on metal live price, making it easy to monitor market movements and make timely decisions.

2. Diversify Your Investments

Don’t put all your money into one type of metal. Instead, invest in a mix of metals like gold, silver, and industrial metals such as copper and aluminum. This way, even if one metal’s price drops, the others might balance out your losses.

3. Use Technical Analysis

Technical analysis involves studying past price data and market trends to predict future price movements. Platforms like PriceVision provide tools to analyze charts and patterns, helping you make better predictions about where the metal live price might go next.

4. Set Clear Goals

Before you invest, decide whether you want to make quick profits or invest for the long term. Short-term trading requires quick decisions and monitoring the market closely, while long-term investing focuses on holding metals until their value grows over time.

How PriceVision Helps Investors

Navigating the unpredictable metal market can be challenging, but tools like PriceVision make it easier to understand metal live price trends and profit from them.

1. Real-Time Price Updates

PriceVision provides accurate and up-to-date information on metal prices, so you’ll always know when the market moves. This feature is particularly helpful for those who want to act quickly and take advantage of sudden price changes.

2. Easy-to-Use Analytics

With PriceVision’s advanced analytics, you can identify trends and patterns in the metal market. These tools use AI to analyze large amounts of data and provide predictions that help you make informed investment decisions.

3. Customized Insights

PriceVision offers personalized recommendations based on your investment goals and preferences. Whether you’re trading metals for short-term gains or investing for the future, the platform tailors its insights to meet your needs.

Risks of Metal Price Volatility

While metal price fluctuations present opportunities, they also come with risks. Knowing these risks can help you prepare better and avoid potential losses.

1. Market Speculation

Speculation by traders can cause sudden spikes or dips in the metal live price, making it hard to predict. This is why staying informed and using tools like PriceVision to track trends is essential.

2. Economic Instability

Global economic changes, such as a recession or inflation, can lead to unpredictable price movements. Diversifying your investments can help minimize the impact of these fluctuations.

3. Overtrading

If you trade too often to take advantage of every price change, you might end up paying high transaction fees or making poor decisions. It’s better to stick to a clear plan and avoid impulsive trades.

Practical Tips for Beginners

If you’re new to metal trading, you might feel overwhelmed by the idea of price volatility. Here are some simple tips to get started:

1. Start with Small Investments

Begin by investing small amounts in metals to understand how the metal live price works. As you gain experience and confidence, you can gradually increase your investment.

2. Learn the Basics

Take time to understand how the metal market operates. Read about factors that affect prices, such as supply-demand dynamics and global economic events.

3. Use PriceVision to Simplify Decisions

Platforms like PriceVision are great for beginners because they provide clear, real-time data and easy-to-use tools. With these resources, you don’t need to be an expert to make informed decisions.

How Global Events Affect Metal Prices

Global events can have a big impact on metal live price trends. Staying informed about what’s happening around the world can help you predict price movements more accurately.

1. Trade Wars and Tariffs

When countries impose tariffs or engage in trade wars, the supply chain for metals is often disrupted. This leads to increased prices as supply becomes limited.

2. Political Instability

Political conflicts or instability in major economies drive up the demand for safe-haven metals like gold, which causes their prices to rise. Keeping track of global news can give you an edge in anticipating these changes.

3. Economic Reports

Reports on inflation, employment, and GDP growth influence how people perceive the economy. Positive reports can stabilize metal prices, while negative ones can create volatility.

Future Trends in Metal Live Prices

The future of metal live price movements will depend on several factors, including technological advancements and global economic recovery.

1. Rising Demand for Industrial Metals

As industries grow and expand, the need for industrial metals like copper and aluminum will increase. This could lead to more price fluctuations, providing new opportunities for investors.

2. Better Prediction Tools

Platforms like PriceVision are continuously improving. With advanced technology and AI, these tools will offer even more accurate predictions, helping investors stay ahead in the market.

Conclusion

Metal price volatility can be intimidating but is also a gateway to profitable opportunities. By understanding what drives metal live price changes and using platforms like PriceVision, you can make smarter investment decisions. Whether you’re new to metal trading or an experienced investor, staying informed and following a clear strategy are the keys to success. With the right tools and knowledge, you can turn market fluctuations into financial gains.

FAQs

1. What is metal live price volatility?

Metal live price volatility refers to the frequent changes in the prices of metals like gold, silver, and industrial metals due to market conditions, supply-demand changes, and global events.

2. How can I profit from metal price volatility?

You can profit by staying updated on metal live price, using tools like PriceVision for analysis, and diversifying your investments to reduce risks.

3. What makes PriceVision helpful for metal trading?

PriceVision provides real-time price updates, advanced analytics, and customized insights, making it easier for investors to navigate volatile metal markets and make informed decisions.

4. What are the risks of trading in metals?

The risks include market speculation, economic instability, and overtrading. Having a clear strategy and using tools like PriceVision can help you manage these risks effectively.

5. Why do global events impact metal prices?

Global events like trade wars, political instability, and economic reports affect the supply and demand for metals, leading to changes in metal live price trends.

To Get Real-Time Price of Metal Visit: https://pricevision.ai/

Source: https://diigo.com/0ymza9