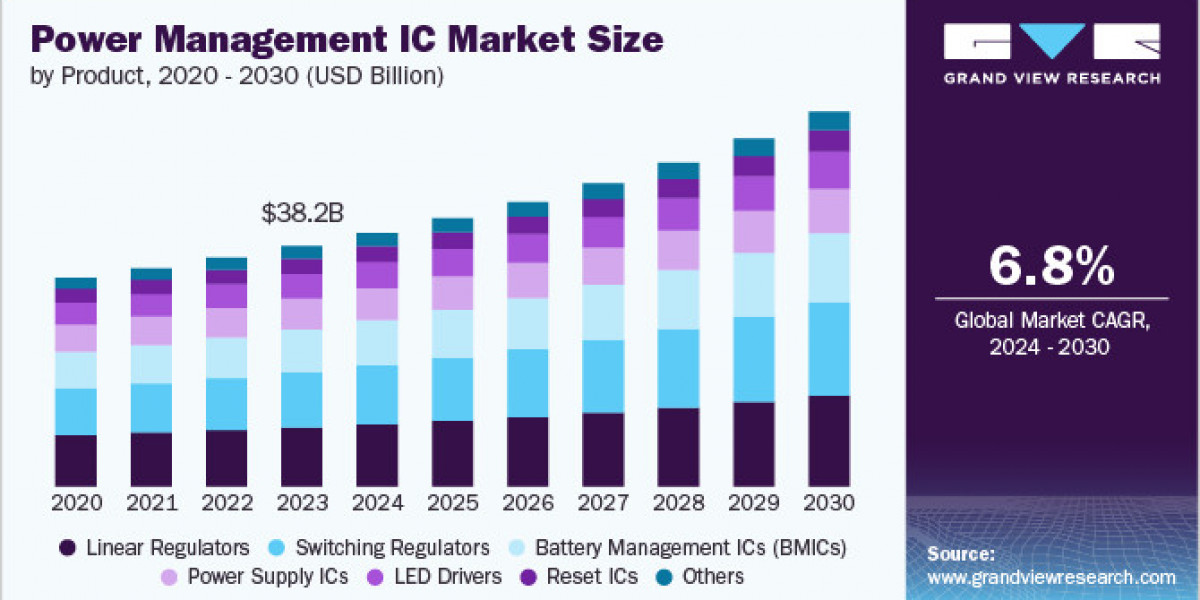

Imagine the intricate dance of electrons within your devices, all guided by a microscopic maestro: the PMIC. In 2023, this Power Management IC market commanded a value of USD 38.22 billion, and it's poised to conduct a steady growth symphony, projected at a 6.8% CAGR from 2024 to 2030. These minuscule marvels are the unsung heroes, efficiently directing the flow of electrical energy, extending the stamina of our batteries, boosting device prowess, and ensuring safe operation across our digital lives, from the sleekest smartphones to the powerful electric vehicles on our roads.

The PMIC market is buzzing with activity, fueled by key trends. Our insatiable desire for smaller, more portable electronics has spurred the creation of PMICs with shrinking footprints and increasing integration. As electronic systems become more intricate, PMICs are tasked with juggling diverse power demands and delivering advanced features like rapid charging and intelligent battery management. The global push for energy efficiency has ignited the development of PMICs that sip power rather than gulp it. Furthermore, the burgeoning Internet of Things and the electrifying rise of the EV market are creating significant demand for PMICs to power a multitude of connected devices and manage the complex energy needs of electric vehicles.

Get a preview of the latest developments in the Power Management IC Market; Download your FREE sample PDF copy today and explore key data and trends

Navigating this landscape are various regulations focused on energy efficiency, safety, and electromagnetic compatibility (EMC). Manufacturers must ensure their PMICs adhere to these standards, from the Energy Star program to safety certifications by organizations like UL and TÜV, and international EMC standards like IEC 61000, to gain access to global markets.

The PMIC market's engine is driven by technological leaps in semiconductor technology, enabling the creation of ICs with superior performance, lower power consumption, and smaller sizes. The ever-increasing presence of smartphones, tablets, laptops, and other electronic companions is a fundamental demand driver. The electric vehicle revolution and the growing sophistication of automotive electronics are forging new avenues for PMICs to manage the power demands of these complex systems. Moreover, the global shift towards renewable energy sources like solar and wind power is creating a need for PMICs to intelligently manage energy storage and distribution.

Significant growth opportunities are lighting up the PMIC market. The rapidly expanding Internet of Things is creating a voracious demand for PMICs to power a diverse array of connected devices. The increasing popularity of wearable technology, like smartwatches and fitness trackers, necessitates PMICs with minuscule form factors and ultra-low power consumption. The electric vehicle transition is driving the demand for high-performance PMICs to orchestrate battery systems and other critical components. Finally, the growing embrace of wireless charging technology is opening doors for PMICs with integrated wireless power capabilities.

Detailed Segmentation

Product Insights

The linear regulators segment dominated the market in 2023 and accounted for more than 25% share of global revenue. These regulators are widely used in low-power applications where efficiency is not the primary concern, such as in consumer electronics, sensors, and small signal processing circuits. Their dominance in the market is largely attributed to their ease of integration into various devices and their ability to provide a stable output voltage with minimal external components. Linear regulators also exhibit low electromagnetic interference (EMI), which is crucial in sensitive analog circuits and communication devices. This makes them a preferred choice in applications where noise can affect performance, such as in medical devices and precision measurement equipment. Furthermore, the increasing demand for compact and energy-efficient devices in the consumer electronics sector continues to drive the market for linear regulators.

Industry Vertical Insights

The consumer electronics segment dominated the market in 2023, due to the proliferation of portable electronic devices such as smartphones, tablets, wearables, and laptops. The continuous demand for longer battery life, faster charging times, and compact form factors in these devices has led to significant advancements in PMIC technology. Manufacturers are increasingly integrating sophisticated power management solutions to optimize energy usage, reduce heat generation, and enhance overall device performance. The widespread adoption of smart devices and the Internet of Things (IoT) has further fueled the demand for efficient PMICs in consumer electronics. Moreover, the shift towards more powerful, feature-rich devices with high processing capabilities and advanced displays requires more complex power management solutions, reinforcing the dominance of this sector in the market. In addition, the trend towards wireless charging and the development of new power delivery standards, such as USB-C and fast charging protocols, have created new opportunities for PMICs tailored for these applications.

Regional Insights

The power management IC market in North America is expected to grow at a significant CAGR from 2024 to 2030, driven by the region's technological leadership, advanced industrial base, and strong focus on energy efficiency. The U.S. and Canada, being key players in the global technology landscape, have a high demand for power management solutions across various industries, including consumer electronics, automotive, and industrial automation. The rapid adoption of electric vehicles, coupled with increasing investments in renewable energy projects, particularly in solar and wind energy, has further accelerated the demand for PMICs.

Key Power Management IC Company Insights

The competitive landscape of the power management IC market is characterized by intense competition among several key players, ranging from established semiconductor giants to innovative startups. Major companies like Texas Instruments, Analog Devices, Infineon Technologies, and ON Semiconductor dominate the market, leveraging their extensive product portfolios, strong research and development capabilities, and global distribution networks. These companies continually innovate to introduce more efficient, compact, and cost-effective PMICs to meet the evolving demands of various industries, including consumer electronics, automotive, and industrial sectors.

Key Power Management IC Companies:

The following are the leading companies in the Power Management IC market. These companies collectively hold the largest market share and dictate industry trends.

- Analog Devices, Inc.,

- Diodes Incorporated

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors

- Renesas Electronics Corporation

- ROHM Co., Ltd.

- Semiconductor Components Industries, LLC (onsemi)

- Semtech Corporation

- Texas Instruments Incorporated

Power Management IC Market Segmentation

Grand View Research has segmented the power management IC market based on product, industry vertical, and region.

- Product Outlook (Revenue, USD Billion, 2017 - 2030)

- Linear Regulators

- Switching Regulators

- Battery Management ICs (BMICs)

- Power Supply ICs

- LED Drivers

- Reset ICs

- Others

- Industry Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

- Consumer Electronics

- Automotive

- Industrial

- IT & Telecommunications

- Healthcare

- Others

- Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Middle East & Africa (MEA)

- United Arab Emirates (UAE)

- Kingdom of Saudi Arabia (KSA)

- South Africa

Curious about the Power Management IC Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.