The organoids market strategic moves are increasingly characterized by mergers and acquisitions (M&A), which play a pivotal role in shaping the competitive landscape. As the market expands rapidly, consolidation through M&A allows companies to enhance their technological capabilities, broaden product portfolios, and strengthen their global presence—ultimately driving sustained growth and innovation.

Accelerating Market Consolidation

Mergers and acquisitions have become a prominent trend in the organoids market as companies seek to combine strengths and streamline operations. This consolidation offers several benefits:

Pooling Resources and Expertise: M&A enables firms to integrate complementary technologies, expertise, and intellectual property, accelerating R&D efforts and product development.

Reducing Competition: By acquiring competitors or startups, companies can increase market share, reduce fragmentation, and achieve economies of scale.

Expanding Geographic Reach: Strategic acquisitions often provide access to new regional markets and established distribution networks, improving global market penetration.

Such consolidation trends help stabilize the market and create dominant players capable of driving technological innovation.

Enhancing Competitive Positioning

Through mergers and acquisitions, companies can strengthen their competitive positioning by:

Broadening Product Portfolios: Acquiring companies with niche or advanced organoid technologies enables a more diversified offering, meeting varied customer needs across pharmaceutical, academic, and clinical sectors.

Accelerating Innovation: M&A provides access to cutting-edge technologies such as gene editing integration, automated organoid production, and multi-organoid platforms, enhancing the pace of innovation.

Improving Operational Efficiency: Consolidation facilitates optimized manufacturing, supply chain integration, and reduced operational costs, contributing to better profit margins and pricing competitiveness.

These strategic moves empower companies to differentiate themselves and maintain leadership in a rapidly evolving market.

Key Market Drivers Behind M&A Activity

Several factors are fueling the surge in M&A within the organoids market:

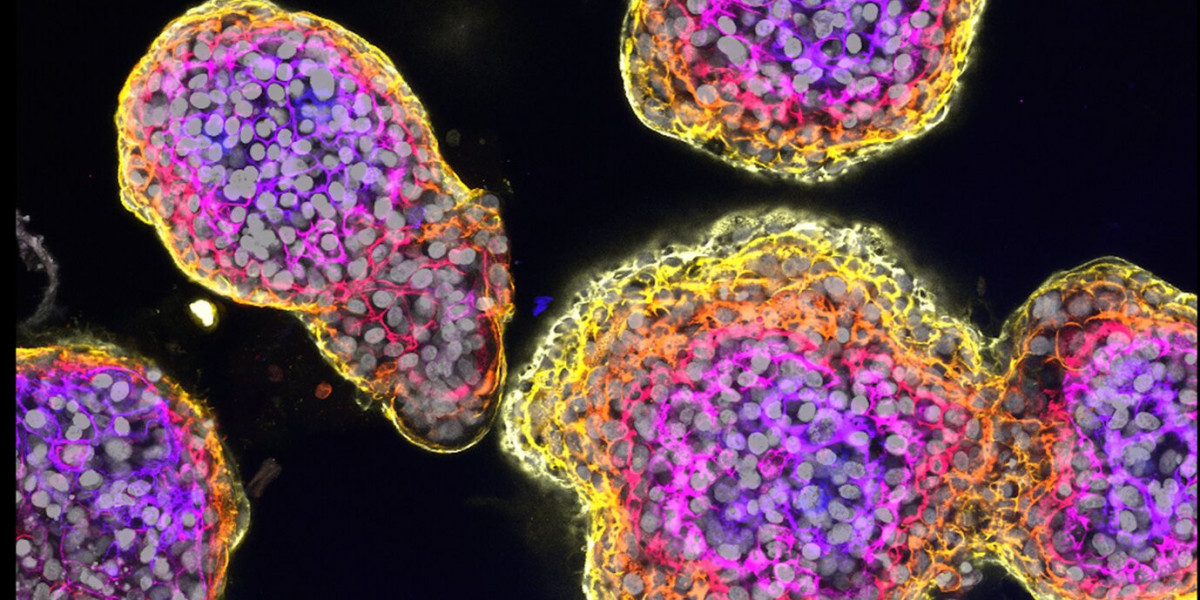

Rising Demand for Complex Disease Models: The need for sophisticated organoid models to study diseases like cancer and neurological disorders drives acquisition of specialized firms.

Increased Funding and Investment: Venture capital and private equity investments create favorable conditions for companies to pursue growth through acquisitions.

Regulatory Encouragement: Clearer regulatory pathways incentivize companies to scale quickly via mergers.

Competitive Pressure: Market players seek to consolidate to mitigate risks associated with fragmented innovation and market entry barriers.

Future Outlook of M&A in the Organoids Market

The trend of strategic acquisitions is expected to continue as the organoids market matures. Companies will likely focus on acquiring startups with novel technologies and expanding into emerging markets to capitalize on regional growth opportunities. Additionally, cross-industry collaborations may increase as firms combine organoid capabilities with AI, bioinformatics, and gene editing.

Conclusion

The organoids market strategic moves through mergers and acquisitions are pivotal in driving market consolidation and enhancing competitive positioning. These activities enable companies to accelerate innovation, expand product offerings, and strengthen their global footprint—ultimately shaping a more robust and dynamic organoids market landscape worldwide.