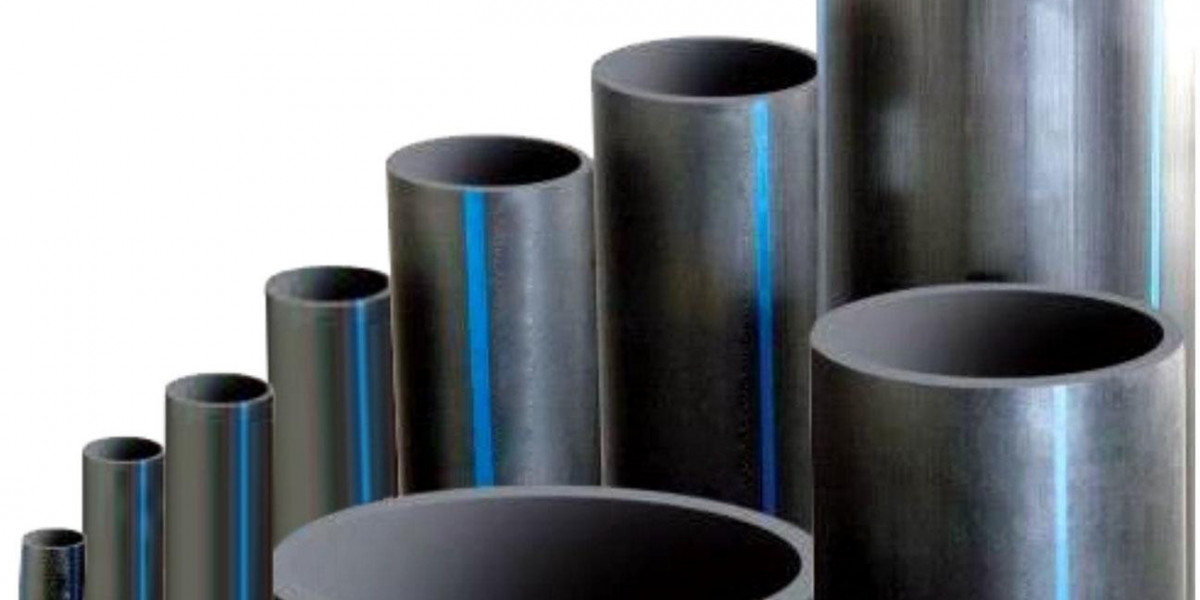

Polyethylene (PE) Pipes Market Challenges

Polyethylene (PE) pipes have gained significant popularity over the past few decades due to their excellent corrosion resistance, flexibility, lightweight nature, and cost-effectiveness compared to traditional piping materials like steel or PVC. These pipes are widely used in various sectors including water supply, gas distribution, sewage, and industrial applications. Despite the growing demand and technological advancements, the PE pipes market faces a number of challenges that could hinder its growth and development. This article explores the major obstacles confronting the polyethylene pipes industry and discusses their implications.

1. Raw Material Price Volatility

One of the foremost challenges in the PE pipes market is the volatility of raw material prices, primarily polyethylene resin. Polyethylene is derived from petrochemicals, making it highly sensitive to fluctuations in crude oil and natural gas prices. Sudden price hikes in these feedstocks can significantly increase production costs for pipe manufacturers, which may be passed on to end-users, thus affecting demand. Additionally, geopolitical tensions, supply chain disruptions, and environmental regulations on fossil fuels contribute to unpredictability in raw material costs, making it difficult for manufacturers to plan long-term investments or pricing strategies.

2. Environmental and Regulatory Pressures

With increasing global emphasis on sustainability and reducing plastic waste, the PE pipes market faces mounting regulatory scrutiny. Governments and environmental bodies are implementing stricter regulations on plastic production, usage, and disposal. While PE pipes offer durability and long service life, concerns remain about microplastic pollution and end-of-life recycling challenges. Compliance with evolving environmental standards often requires investments in eco-friendly production technologies, recycling facilities, or alternative raw materials, increasing operational costs. Furthermore, some regions are promoting the use of biodegradable or bio-based materials, potentially threatening the dominance of traditional polyethylene pipes.

3. Competition from Alternative Materials

The polyethylene pipes market is not without competition. Alternative materials such as PVC (polyvinyl chloride), steel, ductile iron, and copper are also prevalent in the piping industry. Each material offers unique advantages in terms of cost, strength, temperature resistance, or installation methods. For example, steel pipes still dominate high-pressure and industrial applications due to their superior strength, while PVC pipes are often preferred for cost-sensitive projects. PE pipes manufacturers must continuously innovate to improve the mechanical properties and applications of polyethylene pipes to stay competitive. Moreover, end-users sometimes prefer traditional materials because of established trust and perceived reliability, posing a market penetration challenge for PE pipes.

4. Technical Limitations and Performance Concerns

Despite numerous benefits, PE pipes have some technical limitations that restrict their use in certain applications. Polyethylene has lower temperature resistance compared to metal pipes, making it unsuitable for extremely high-temperature fluids or environments. Its mechanical strength, while adequate for many uses, is not always comparable to metal alternatives, especially under high-pressure conditions. Additionally, concerns over long-term UV degradation require PE pipes to be either buried underground or coated with protective layers when used outdoors, adding to installation complexity and cost. These technical constraints limit the market scope of PE pipes and necessitate ongoing research to enhance their properties.

5. Installation and Infrastructure Challenges

Although PE pipes are lightweight and flexible, which typically facilitates easier installation, the actual deployment can face practical challenges. Installing PE pipes requires specialized welding and fusion techniques to ensure leak-proof joints, demanding skilled labor and adequate training. In regions where such expertise is scarce, improper installation can lead to failures, leaks, and customer dissatisfaction. Moreover, integrating PE pipes into existing infrastructure composed of different materials requires compatible fittings and transition solutions, complicating retrofit or upgrade projects. In some cases, lack of awareness or resistance to change among contractors and engineers slows the adoption of PE piping systems.

6. Market Fragmentation and Pricing Pressure

The global PE pipes market is highly fragmented, with numerous regional and local manufacturers competing alongside international players. This fragmentation often leads to intense price competition, squeezing profit margins. Smaller players may struggle to invest in advanced production technologies or research and development, limiting their ability to innovate or maintain consistent quality. Price-sensitive customers may opt for cheaper, lower-quality products, affecting the overall market reputation and growth. Additionally, the influx of counterfeit or substandard PE pipes in some markets poses safety risks and damages consumer trust.

7. Supply Chain Disruptions

The global supply chain complexities have become increasingly evident in recent years due to factors like the COVID-19 pandemic, geopolitical tensions, and transportation bottlenecks. These disruptions have impacted the availability and timely delivery of raw materials, machinery, and finished products for the PE pipes industry. Delays in supply can lead to project slowdowns, cost overruns, and strained customer relationships. The market must adapt by diversifying suppliers, increasing local production capacities, or adopting more agile inventory management strategies to mitigate supply chain risks.

8. Lack of Awareness and Standardization

In many developing countries, there is still limited awareness about the benefits and applications of PE pipes, especially in rural or underdeveloped regions. Lack of technical knowledge among end-users, contractors, and decision-makers often results in underutilization or incorrect use of polyethylene pipes. Furthermore, varying standards and certifications across countries create challenges for manufacturers aiming to expand internationally. Harmonizing quality standards and promoting industry best practices are critical to building confidence and encouraging wider adoption of PE pipes.

Conclusion

While polyethylene pipes offer numerous advantages that make them an attractive choice for modern infrastructure projects, the market is not without its share of challenges. Volatile raw material prices, regulatory pressures, competition from alternative materials, technical limitations, installation difficulties, pricing competition, supply chain disruptions, and lack of awareness all pose hurdles to market growth. Addressing these challenges requires collaborative efforts from manufacturers, regulators, and end-users, focusing on innovation, sustainability, skill development, and quality assurance. By overcoming these obstacles, the PE pipes market can continue to expand and contribute significantly to global infrastructure development and sustainable water and gas distribution systems.

Get More Details:

| https://www.pristinemarketinsights.com/polyethylene-pe-pipes-market-report |